Robots and Cocktails

Robots and Cocktails

There is currently a great deal of expectation and assumption that we ubiquitous accountants will shortly be replaced by automation and artificial intelligence (AI) and that as a consequence we will gradually become redundant. This is being touted by both academics and professional accountants alike. But is this really likely to happen any time soon and is the expectation overdone?

What is AI? Simplistically, it is being enthusiastically promoted as computer programming that will replicate human functionality and intelligence. This is certainly a fascinating prospect.

At this stage though, let me state categorically that I am not reacting to technological development. On the contrary, I am in fact very much in favour of new technology and the savings and efficiencies that will result in performing mundane tasks, particularly through automation, where it is practicable. “Cloud” accounting makes perfect sense and I will shortly be sending my own PC based accounting up there. International accounting standards have become so complex that the only way to be sure that financial statements is to make use of software that does it all for you, so to speak. These are great time savers and they do save money for our clients.

A number of accounting software packages are currently available that claim to automate accounting transactions by interfacing their software with bank’s software to enable the download of bank transactions into client general ledgers. These packages facilitate the generation of debtors and creditors invoices by relying on clients to scan or use their cell phones to take pictures of transaction documentation. With this data, service providers of the software claim to be able to produce accurate VAT returns and financial statements. I have used the word claim because there is a snag. All of the transactions downloaded have to be edited and corrected. The extent of this and whether or not is done accurately is a worry to me.

I have discussed this type of software with a senior representative of one of the well-known companies offering this service (who shall for obvious reasons remain anonymous). It is not what it appears to be on the surface. This service provider admitted as much. First of all, only larger companies who have high volumes of transactions to make it viable for both parties typically participate. Secondly, company personnel have to be trained quite extensively and have to buy-in to the process and thirdly there still is a great deal of transaction editing to ensure correct accounting.

So what is really happening from an accounting perspective with those companies that use service providers to perform their accounting function? The service provider, in conjunction with the client company generates numerous accounting rules and conditions applicable to each particular client to try to facilitate the processing of each transaction.

However, the reality is, that in order to produce accurate financial statements, the rules and conditions can never be enough and manual intervention will always be necessary. A standard set of rules cannot presume to cater for all transaction possibilities. To name but a few examples – profit or losses on disposals of assets, forex related transactions, accruals and deferrals. All entail subjective accounting decisions which have to be made. But with this type of software is there much AI involvement? No, not really – this is nothing more than automation.

Let’s not forget the costs either. Instead of having their own accounting staff, these companies now pay a third party to maintain their accounting records, generate VAT returns and financial statements etc. Will the fees charged by the service provider ultimately be less than employing accounting staff? Cost benefits will of course vary from company to company and each will decide what makes economic sense. More and more companies are however fact using automation and it does seem to be gaining in popularity.

Let’s consider some of the consequences of AI for the accounting world.

-

- Accounting is a finite and a subjective science, requiring in particular, complex subjective decisions to be made for all kinds of transactions, including the assessment and valuation for disclosure of assets and liabilities. Compounding this subjectivity are the accounting principles, policies and rules promulgated by numerous statutes such as the Companies Act, local accounting bodies such as SAICA and SAIPA and also the International Accounting Standards Board. Will AI threaten the efficacy of statutes and these bodies?

- Financial statements are primarily prepared for users such as banks, creditors and investors etc. It is hard to imagine that users will have confidence in exclusively computer generated financial statements. If they do, will this not suggest a degree of recklessness.

- There are the accounting professionals with all their various qualifications offered by tertiary institutions. Will these all become redundant too

- It is not inconceivable that there will be some kind of a pushback against AI, not only from the accounting profession, but society itself, for the simple reason that too many jobs will be at risk. This is particularly relevant for developing countries which need to create jobs, not sacrifice them.

- Overlooked in the AI “euphoria” is the fact that many small organisations, probably most, including SMME’s, do not maintain formal accounting records and many present their accountants with a box full of documents once a year to sift through and create financial order. It is hard to imagine how AI will perform this task.

- The auditing profession too would undoubtedly be affected by AI. What will become of audits and what it entails, with its internal controls, checks and balances etc.? Will users of financial statements accept that financial statements are no longer being audited or be forced to accept that the audit is done invisibly by AI as well.

- Corporate governance worldwide has come under scrutiny and for good reason. Are investors who rely so much on good corporate governance ready to accept accounting which will to all intents and purposes simply be generated without direct human oversight? Computer programmes will be blamed for errors; fraud etc. and pinpointing accountability will be extremely difficult.

- There is SARS, who currently query almost all tax returns. It would be interesting to see how SARS view AI and its ramifications and how public officers will have to unravel computer generated transactions to respond to SARS queries.

- Litigation too will become much more complex. Who will the legal profession sue? A computer programme, a robot?

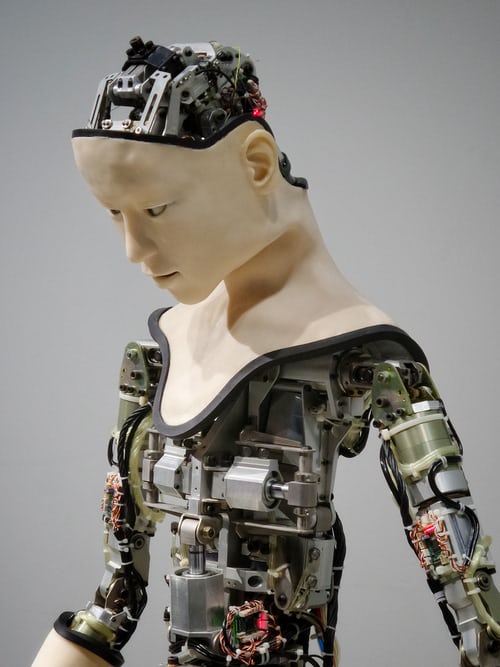

Not surprisingly, the AI notion has been around for a number of years already but despite the growing number of proponents, remains quite far from becoming a reality. A number of robots have been developed and have been showcased but if the truth be told, their intelligence and functionality remains extremely limited.

In conclusion, I must repeat that I welcome technological development. However I do believe that right now, expectations for AI, is so far as it affects the accounting profession is a little ahead of itself.

Our generation should not expect this highly anticipated product of the fourth industrial revolution to happen any time in the near future. Perhaps when only we retire a robot might be available to serve us cocktails, shaken not stirred.

Ian Juszkiewicz

27th August 2019